What’s Really Happening with Drug Prices in 2025?

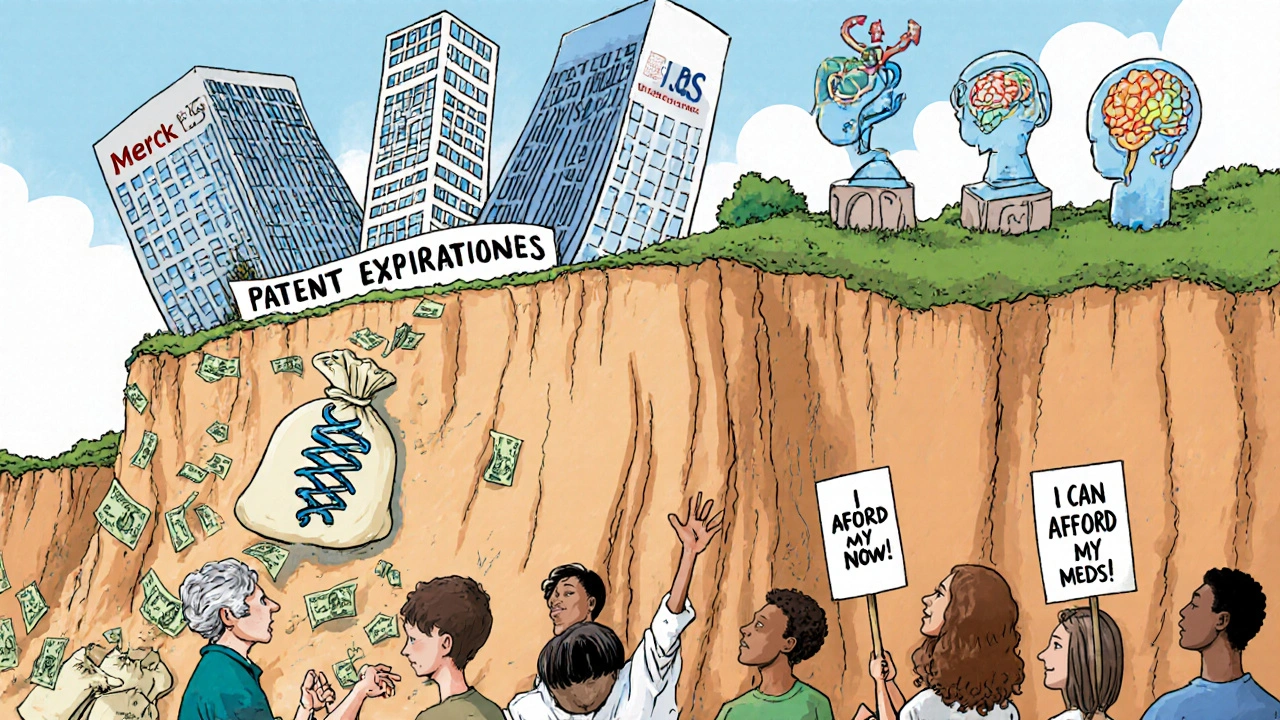

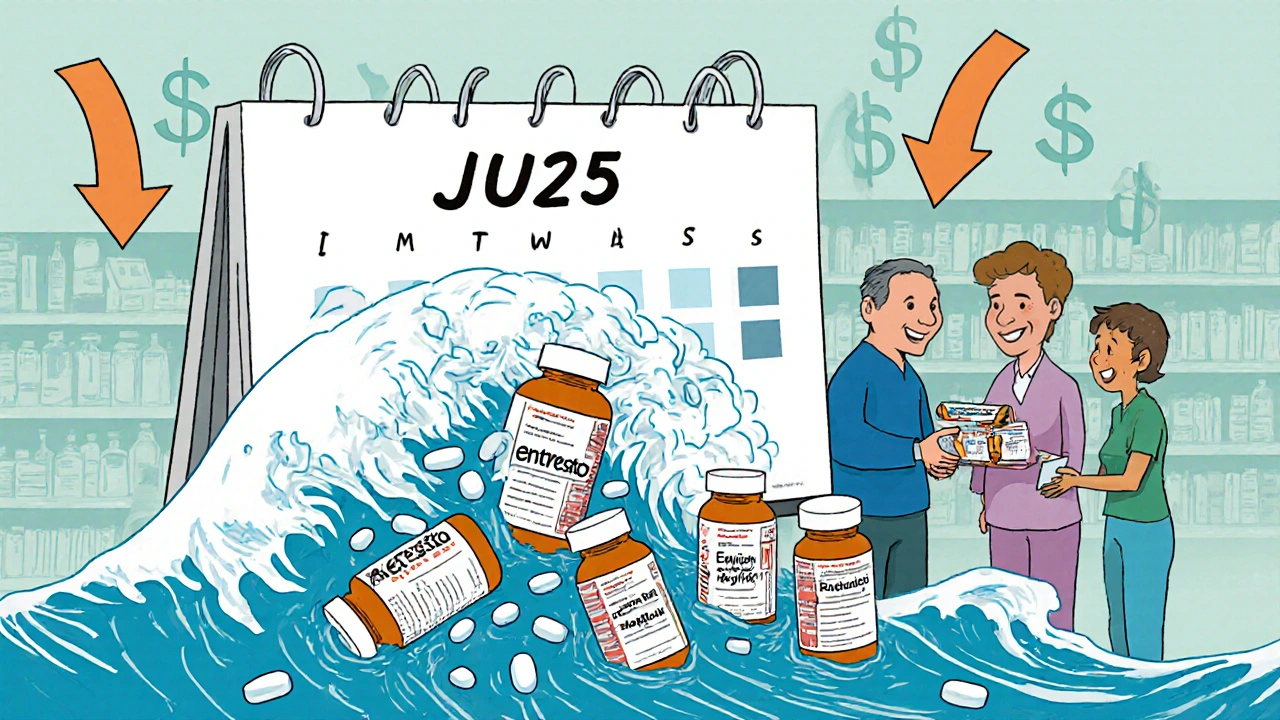

If you or someone you know takes a daily pill for heart failure, cancer, or blood clots, your out-of-pocket costs could drop by 80% or more starting next year. That’s not a guess-it’s the reality of the biggest wave of patent expirations in pharmaceutical history. Starting in July 2025, Entresto (sacubitril/valsartan) will lose its core patent protection in the U.S., opening the door for generic versions to hit pharmacy shelves. This isn’t an isolated event. Between 2025 and 2030, more than $187 billion in annual global sales from top drugs will become available to generic and biosimilar makers. For patients, that means cheaper meds. For pharmacies and insurers, it means major logistics shifts. For drugmakers, it’s a financial earthquake.

The 2025-2030 Patent Cliff: A Timeline of Key Drugs

Patent expirations don’t happen all at once. They roll out like a slow-motion avalanche, with some drugs losing protection months apart. Here’s what’s coming up, by year:

- July 2025: Entresto (Novartis) - The $7.8 billion heart failure drug loses its key combination patent (US8329752). Generic versions will be available immediately after this date.

- November 2026: Eliquis (Bristol Myers Squibb/Pfizer) - The $13.2 billion blood thinner’s main crystalline form patent expires. Multiple generic competitors are already approved and ready to launch.

- 2027: Ibrance (Pfizer) - The $4.8 billion breast cancer drug loses patent protection. Biosimilars are already in development, but small-molecule generics will enter faster.

- 2028: Keytruda (Merck) - The $29.3 billion cancer immunotherapy loses its core composition patent. This is the single largest patent expiration in history. No direct generic exists-it’s a biologic, so biosimilars will take longer to arrive.

- 2029-2030: Trulicity (Eli Lilly), Humira biosimilars (full market entry), and others follow. By 2030, nearly half of today’s top-selling drugs will be off-patent.

These aren’t obscure drugs. They’re the ones millions rely on every day. Entresto keeps heart failure patients alive longer. Eliquis prevents strokes. Keytruda helps people with advanced lung cancer live years longer than before. When these drugs go generic, the system changes.

Why Some Drugs Go Generic Faster Than Others

Not all drugs are created equal when it comes to patent expiration. There are two main types: small-molecule drugs and biologics.

Small-molecule drugs like Entresto and Eliquis are made from chemical compounds. Their formulas are easier to copy. Once the patent expires, generic manufacturers can produce identical versions in 6-12 months. These generics typically drop to 10-20% of the brand price within a year. In the case of Entresto, patients paying $300 a month could soon pay $30.

Biologics like Keytruda are made from living cells. They’re far more complex. You can’t just copy the recipe-you have to recreate the entire biological process. That’s why biosimilars take 18-24 months to get approved after patent expiry. Even then, they’re not exact copies. They’re “similar enough.” As a result, they only cut prices by 30-40% initially, and it takes 3-5 years for them to capture half the market.

The FDA’s Orange Book lists all small-molecule patents. The Purple Book tracks biologics. Both are public, and pharmacy teams use them daily to plan for upcoming expirations.

Who Wins and Who Loses When Patents Expire

When a blockbuster drug loses patent protection, the winners are clear:

- Patients - Lower copays. Many will switch to generics immediately. A 2024 American Heart Association survey found 68% of heart failure patients would switch to generic Entresto the moment it’s available.

- Insurers and PBMs - Lower drug spend means lower premiums. The Congressional Budget Office estimates these expirations will save the U.S. healthcare system $312 billion between 2025 and 2035.

- Generic manufacturers - Companies like Teva, Mylan, and Sandoz are investing billions to be first to market. Teva alone has 37 products in development targeting the 2025-2030 cliff.

The losers? The drugmakers who built their businesses on these drugs.

- Merck could lose up to $31 billion in revenue by 2030, mostly from Keytruda.

- Bristol Myers Squibb stands to lose $13 billion from Eliquis alone.

- Novartis will see a major hit from Entresto’s $7.8 billion in annual sales.

These companies aren’t sitting still. Merck is pouring $12 billion into next-gen cancer drugs. BMS bought Karuna Therapeutics for $4.1 billion to build a new pipeline. They’re betting on innovation to replace the lost revenue.

What Happens in Pharmacies When Generics Arrive

It’s not just about new pills on the shelf. Pharmacies and hospitals are preparing for a massive operational shift.

By October 2024, 87% of hospital pharmacy directors said they were already adjusting inventory, training staff, and negotiating new prices with pharmacy benefit managers (PBMs). Some hospitals have already locked in 60% price cuts for Entresto in anticipation of the July 2025 launch.

Pharmacists are learning how to explain the switch to patients. Many are worried about confusion. “I’ve seen patients panic when their brand drug disappears,” said one pharmacist on Reddit. “They think the generic is weaker. It’s not. It’s the same thing, just cheaper.”

There’s also a risk of shortages. When Humira’s biosimilars launched in 2023, there were supply chain hiccups. Pharmacists are now on alert. “We’re not waiting until the last minute,” said Sarah Johnson, a pharmacy tech with 142,000 followers on Facebook. “We’re stocking up early.”

Why This Matters More in the U.S. Than Anywhere Else

Patent expirations happen worldwide. But the U.S. feels this more than any other country.

Why? Because the U.S. doesn’t regulate drug prices. In Europe or Canada, governments cap what a drug can cost-even before patents expire. In the U.S., prices are set by the market. That means when a drug like Keytruda costs $150,000 a year, that’s what insurers and patients pay.

When generics arrive, the price drop is dramatic. In Europe, Entresto might cost $1,200 a year. In the U.S., it’s $3,600. After generics hit, that could fall to $400. That’s why the U.S. accounts for 63% of the $187 billion in at-risk revenue-even though it has only 20% of the world’s patients.

That’s also why the FDA has received 127 new generic applications for 2025 expirations-a 27% jump from last year. Companies know the U.S. market is worth fighting for.

What You Should Do Now

If you’re on one of these drugs, here’s what to do:

- Know your drug - Is it a small molecule (like Eliquis) or a biologic (like Keytruda)? Check the FDA’s Orange Book or Purple Book.

- Ask your doctor or pharmacist - When is the patent expiring? When will generics be available? Don’t wait until your prescription runs out.

- Check your insurance plan - Many PBMs will automatically switch you to the generic. But some require prior authorization. Call now.

- Consider switching early - If your insurer offers a discount now, take it. There’s no downside. Generics are just as safe and effective.

Don’t assume your doctor will bring it up. Most are focused on treatment, not cost logistics. You have to be your own advocate.

What Comes After the Patent Cliff?

By 2030, the pharmaceutical industry will look completely different. The top 10 drugmakers could shrink to six or seven after mergers. Innovation will shift toward gene therapies, RNA drugs, and AI-designed molecules. But for now, the focus is on surviving the next five years.

The patent cliff isn’t just a financial event. It’s a human one. It means a diabetic patient in Ohio can afford their insulin. A cancer patient in Texas can keep taking Keytruda without bankruptcy. A grandmother in Florida can fill her heart medication without choosing between groceries and pills.

This isn’t the end of big pharma. It’s the beginning of a fairer system-one where life-saving drugs aren’t locked behind corporate patents for decades. The timeline is set. The science is ready. The only question left is: Are you prepared to use it?

Erika Sta. Maria

November 21, 2025 AT 13:07 PMSo let me get this straight... we're celebrating drug companies getting *robbed* of their monopoly profits like it's some kind of moral victory? 🤔 Meanwhile, the same companies that made billions off these drugs are now 'investing in innovation'-which means they'll just patent the next thing and charge $200K/year again. This isn't justice. It's capitalism doing a slow clap while people still can't afford insulin. #patentcliffisjustrearrangingdeckchairs

Steve Harris

November 22, 2025 AT 10:04 AMThis is one of the most important public health developments in a generation. The data is clear: generics reduce out-of-pocket costs by 80-90% without compromising efficacy. The FDA’s bioequivalence standards are rigorous. Patients who fear generics are often misinformed. Pharmacists are trained to explain this-don’t hesitate to ask. This is a win for patient autonomy and fiscal responsibility. Let’s not let fear or misinformation derail progress.

Logan Romine

November 24, 2025 AT 09:21 AMSo Entresto goes generic... and suddenly we're all gonna be like ‘OMG I’m saving $270/month’ 🤑 Meanwhile, Merck’s CEO is probably crying into his $12M golden pill dispenser. 🥲 Honestly, if you’re still paying full price for a drug that’s been around for 10 years, you’re not being loyal-you’re being scammed. Time to upgrade your moral compass, not your prescription.

Chris Vere

November 25, 2025 AT 14:13 PMThe patent system was designed to incentivize innovation not to create permanent monopolies. When a drug saves lives and its patent expires it is only natural that access should expand. The economic impact is significant but the human impact is greater. Many families will breathe easier knowing they can afford treatment. This is not a crisis for industry but a correction for humanity

Pravin Manani

November 27, 2025 AT 12:00 PMThe distinction between small-molecule generics and biosimilars is critical here. For small molecules like Entresto and Eliquis, bioequivalence is straightforward-FDA requires 90% confidence interval within 80-125% for AUC and Cmax. But for Keytruda, biosimilars must demonstrate similarity across multiple analytical, preclinical, and clinical endpoints. That’s why the price erosion is slower. The real bottleneck isn’t manufacturing-it’s regulatory complexity and payer hesitancy. We need better education on biosimilar equivalence.

Mark Kahn

November 28, 2025 AT 18:26 PMIf you're on one of these meds, DO NOT WAIT. Talk to your pharmacist now. Ask when the generic is coming. Ask if your insurance will switch you automatically. Some plans will make you jump through hoops. Call your PBM. Save yourself the stress later. This is the easiest money-saving move you’ll make all year.

Leo Tamisch

November 30, 2025 AT 03:42 AMAh yes, the great generic awakening. 🌅 Where once we had innovation, now we have... cheaper pills. How poetic. The real tragedy isn’t the loss of patent protection-it’s that we’ve reduced life-saving medicine to a commodity battle between Teva and Walmart. Next up: generic oxygen. I’m sure the FDA has a Purple Book entry for that too. 🤦♂️

Daisy L

December 1, 2025 AT 22:25 PMAMERICA IS FINALLY WAKING UP!!! 🇺🇸🔥 This is what happens when you stop letting Big Pharma hold the whole country RANSOM! $150K for Keytruda? NOPE. $30 for the same damn drug? YES. I’ve been screaming this for YEARS. If you’re still paying full price, you’re literally funding the yacht club of some CEO in Switzerland. Switch. Now. Your wallet will thank you. And if someone says ‘but generics aren’t as good’-tell them to go read the FDA’s bioequivalence guidelines. 📚💥

Anne Nylander

December 3, 2025 AT 08:59 AMI just found out my mom’s on Entresto and she’s been paying $300 a month 😭 I called her pharmacy today and they said generics will be here in July!! I’m crying happy tears. I’m gonna help her switch as soon as it’s available. She’s 72 and this could mean she can afford her groceries again. Thank you for sharing this info!!!

Donald Frantz

December 4, 2025 AT 16:24 PMThe assumption that generics will immediately dominate the market ignores real-world dynamics. Payer contracts, formulary restrictions, and physician inertia mean many patients won’t switch for 18-24 months. Also, biosimilar adoption for Keytruda will be slow-doctors are cautious with immunotherapies. Don’t assume price drops will be instant. The real battle is in the reimbursement layer, not the pharmacy shelf.

Sammy Williams

December 5, 2025 AT 02:37 AMI work in a rural pharmacy. Last year when Humira biosimilars came in, we had patients showing up crying because they thought their ‘special medicine’ was gone. We had to explain over and over: same drug, different name, 70% cheaper. It’s wild how attached people get to brand names. Honestly? Most don’t even know what’s in their pill. Just tell ‘em it’s safe. Then watch the savings roll in.